A Travelers Insight Into Tax Season

Quick Reference Table of Contents

When it comes to tax season; travelers and full-time RVers can make it as simple or as challenging as they like. Tax season for me personally, I like to make it as simple as possible. By claiming residence in one of the 9 states that have no income tax.

Foreign Earned Income Exclusion Tax Loophole For Travelers

This is easier for me than your average citizen because I am constantly traveling, and can easily provide proof of residency anywhere I choose. Another great advantage of being a full-time traveler is the FEIE (Foreign Earned Income Exclusion) which allows a full-time traveler or RVer to delete up to $100,000 of their taxable income. As long as you meet the requirements. Which is reside outside of the country for 335 days.

Considering there are so many ways to generate a stream of income in today’s “digital” world, and with the constant crossing of borders between states and countries, there’s a buffet of loopholes for full-time travelers that would allow you to take advantage of the Foreign Earned Income Exclusion.

If your thinking of living and working abroad check out my popular 83 ways to pay for a life travel.

Plan For Tax Season

Last spring I wrote a transparent article on how you could save $20,000 in less than 3 months, and in that article, I provided a tip that might create severe financial penalties to myself or anyone looking to follow in my footsteps.

Last spring I wrote a transparent article on how you could save $20,000 in less than 3 months, and in that article, I provided a tip that might create severe financial penalties to myself or anyone looking to follow in my footsteps.

So today, I want to revisit that “desperate traveler’s” method to saving money fast in regards to claiming exempt from taxes on my paycheck, and what happened to me as a result of that filing status.

Last winter I grabbed a temp agency job in hopes of saving $20,000 for my big trip around the world. When filling out my “new hire” paperwork I claimed exempt from all Federal and State taxes to be withdrawn from my paycheck.

Paycheck Deductions for Tax Season

I was still forced to pay medicare and social security financial obligations. But those paycheck deductions were closer to 0.5% than the standard 25% of taxes being taken out of my paycheck. So instead of trying to save $20,000 from 75% of my paycheck, I put myself in a position to hit my $20,000 goal using 99.95% of paycheck faster.

This set me up for future financial consequences come tax season. Unknowing what my tax obligations would be in February I’ve been living off of a $1,500 budget for the last 8 months. Not exactly penthouse living, but I haven’t had to report to a job in over 240 days.

Filing Your Taxes

So what happened?

Using H & R Block to file my taxes I reported $27,000 in income last year. Before any credits, deductions or any other adjustments to my taxes, I owed the IRS a whopping $1,100. After-tax credits, deductions, and adjustments I was awarded a $40 refund from the IRS.

Consult a Tax Expert

I am NOT an accountant, tax expert, certified CPA. I don’t even have the credentials to offer tax filing guidance or suggestions. Every person’s situation is unique. What worked for me may not work for you. Heck, what worked for me this year may not even work for me next year.

This year claiming exempt from Federal & State taxes on my paycheck allowed me to save $20,000 in 3 months, and pursue my travel dreams of full-time RV living without any of the stress of an employer.

Tax Season Tips

What can you do to lower your financial tax obligation as a full-time RVer and traveler?

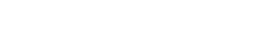

Tax Tip #1 ~Claim residency in a state with no income tax.

9 States With No Income Tax

- Alaska ~ *** PRO TIP*** RESIDENCY IN ALASKA ALSO MAKES YOU ELIGIBLE FOR OIL DIVIDENDS

- Florida

- Nevada

- New Hampshire

- South Dakota

- Texas

- Tennessee

- Washington

- Wyoming

The other day when I did my taxes it reminded me of when I was backpacking through Thailand. Where I forgot which state I had last worked in so I filled out a tax return for each state I might have worked in. One state said I owed them. Another state said I would be rewarded with a hefty return, and another state didn’t even require me to file a tax return. Because of this discovery, I have been claiming residency in one of these 9 states to lower my financial obligation come tax season for over a decade.

Another option to look into is the saver’s tax credit.

Tax Tip #4 – Lower Your Financial Obligations With The Savers Tax Credit

What Is the Saver’s Credit?

The saver’s tax credit is a program from the IRS that allows individuals to lower their financial tax obligations by giving you credit for financial contributions to 401k, 403b SIMPLE, SEP, or governmental 457 plans. As well as traditional and/or Roth IRAs. The saver’s tax credit is a wonderful IRS program that rewards individuals for investing in their retirement on their own.

The saver’s tax credit is what turned my tax obligation this fiscal year into a refund for me personally. Even if you can’t commit to the max allowed per year, which is currently set at $6,000. Every little bit helps and the more credit you get the fewer tax obligations you will have come tax season.

Tax Tip #3 -Itemize Your State Sales Tax

Itemizing your state sales tax is like doubling down on a made black jack  hand. If you claim residency in a state with no income tax you can use the sales tax you paid throughout the year as a deduction to lower you tax liabilities.

hand. If you claim residency in a state with no income tax you can use the sales tax you paid throughout the year as a deduction to lower you tax liabilities.

So by claiming residency in a state that doesn’t require income tax you essentially get to deduct a percentage of your taxable income just for doing every day shopping as well.

A double whammy in your favor! You can get the form to deduct your sales tax directly from the IRS or following this link

I didn’t create this travel blog to give you tax tips, but I did create this website to share my experiences with you. In hopes that my failures could turn into tips of what not to do, or that my successes could help make your travels easier and more adventurous.

If you want to read how even a seasoned globetrotter still makes rookie traveler mistakes. Check out this comical RV road trip recap from last fall.

Future of Tax Season for Traveler’s

I’ve been living out of an RV full-time for over a decade now. Backpacking and other longterm travel for over a decade before that. Every year I file my taxes usually no later than the first week of February, and every year I get a return.

This is the first year the standard deduction has drastically increased. The first-year contributions to either IRA have increased by 20%. This is the first year that I’ve been rewarded by the IRS for being poor.

I’m not jumping on any politicians bandwagon because in my eye’s it’s still choosing the “Lesser of two evils,” but this tax season was much easier to navigate than any of the previous tax seasons I have participated in.

Was that because I claimed exempt with my employer? NO!!!!! Tax season for me as a full-time traveler was easier this year because the standard deductions were raised for everyone. Contribution credits were also raised for everyone.

Easy & Free Tax Software

Tax software like H&R Block or Turbo Tax makes it idiot-proof to do your own taxes. Because all you have to do is take the numbers from your W2 and input them into the corresponding box. Then answer some multiple-choice questions. The whole process takes less than an hour to file your taxes, and if you’re willing to spend a few more dollars you can do it even faster.

With the advancement of technology, you can take a picture of your W2 and it will fill in the boxes for you. It’s like depositing a check with your phone. Simple, quick and painless.

You can do your taxes from anywhere in the world there’s an internet connection. Which is what I’ve been doing for at least 10 years. I have never paid more than $35 to file my taxes, and that was only to file a state return. Filing a federal return has been free for me while using H & R Block tax software for over a decade.

Filing your taxes isn’t hard. You don’t need to know any math. Don’t need to know what forms to fill out. Today’s technology does all of that for and it’s free unless you have to file a state tax return. I use H & R Block, but there are plenty of online tax software websites you can use. The only reason I use H & R Block is because it’s free, a household name and if there is ever an issue they have brick and mortar facilities I can visit.

Filing your taxes isn’t hard. You don’t need to know any math. Don’t need to know what forms to fill out. Today’s technology does all of that for and it’s free unless you have to file a state tax return. I use H & R Block, but there are plenty of online tax software websites you can use. The only reason I use H & R Block is because it’s free, a household name and if there is ever an issue they have brick and mortar facilities I can visit.

Leave your comments, complaints and recommendations in the comments below. Check out more RV life articles, tips & guides here.